Compute present value

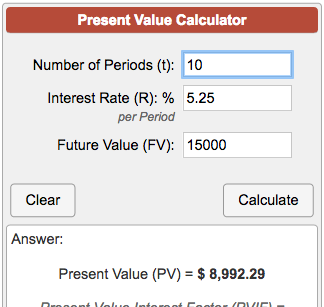

The present value of receiving 5000 at the end of three years when the interest rate is compounded quarterly requires that n and i be stated in quarters. Sum the Present Value column.

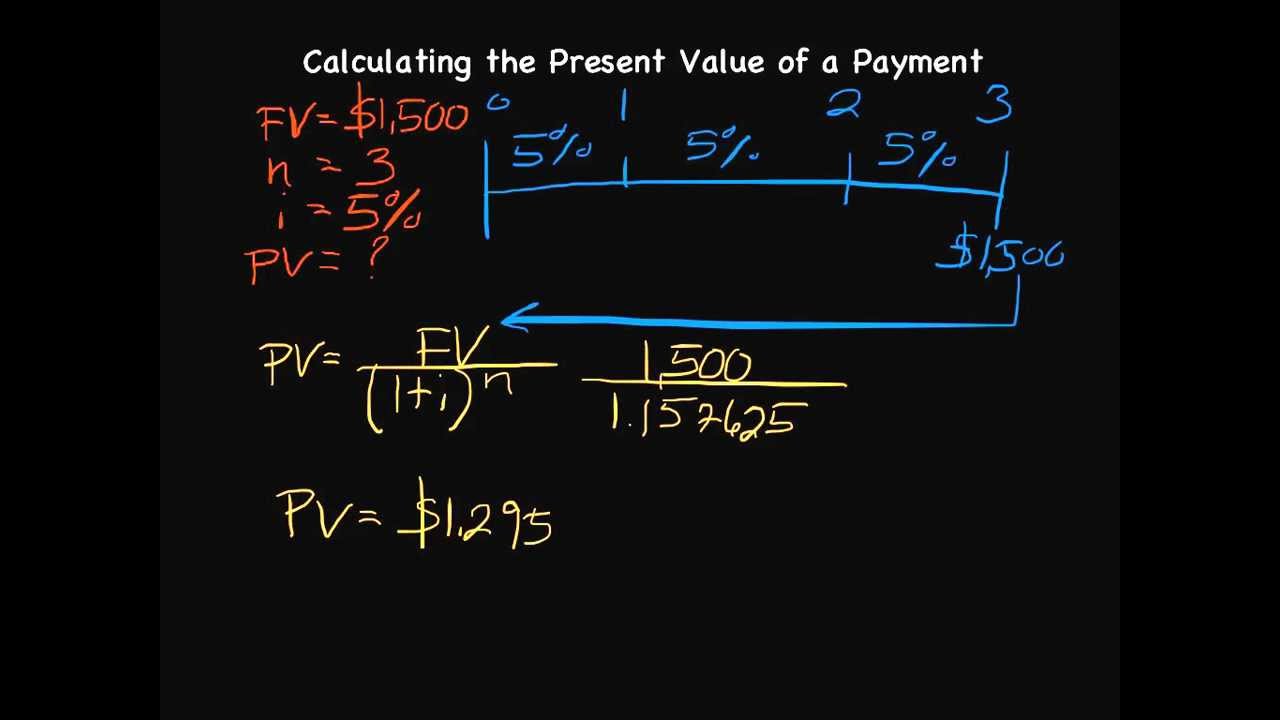

How To Calculate Present Value Youtube

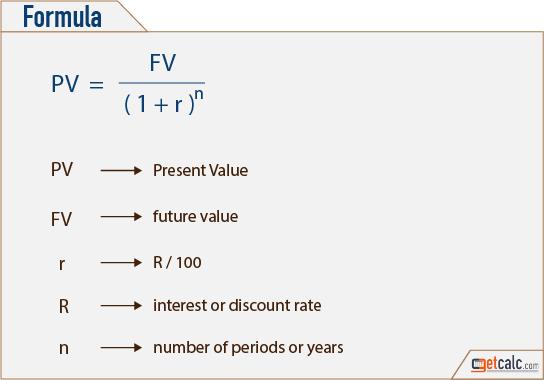

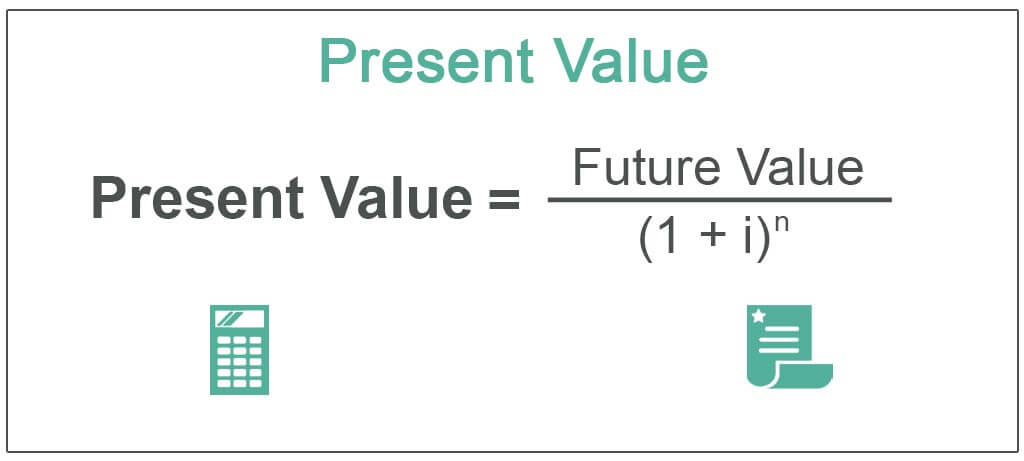

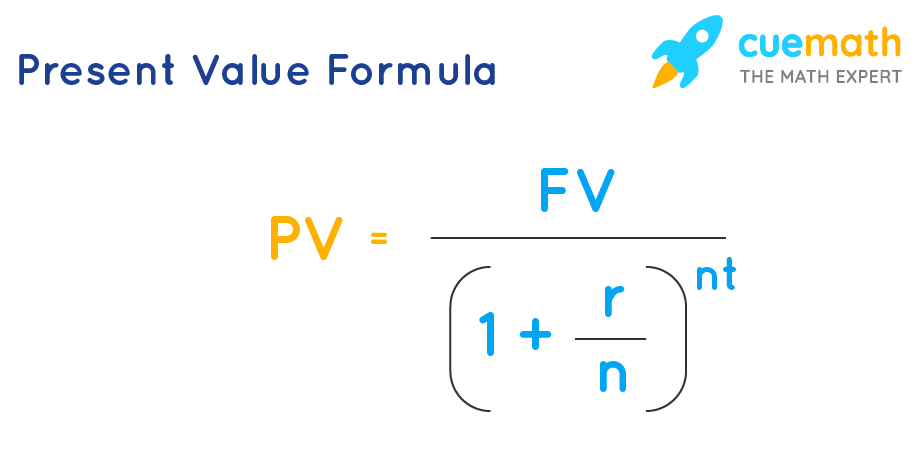

The present value formula for annual or any period really interest.

. Use the PV of 1 Table to. The Present Value is calculated as. PVfrac C 1in P V 1 inC.

The present value formula PV. By using the present value formula we can derive the value of money that can be used in the future. What is the Formula to Calculate the Present Value.

Easy computation of savings and investments. Present Value of Terminal Value PVTV TV 1 r 10 US64b 1 53 10 US38b. Calculating the net present value of a stream of cash flows consists of discounting each cash flow to the present using the present value factor and the appropriate number of.

The general solution comes in this formula. Where r is the discount rate and t is the number of. In practice there are three steps to compute the present value of a bond.

Present Value Future Value 1 Interest Rate Per Period-Number of Periods Present Value Definition The Present Value Calculator will instantly calculate the present value of any future. The Present Value Formula. Once you have calculated the present value of each periodic payment separately sum the values in the Present Value column.

The inputs for the present value PV formula in excel includes the following. Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at. RATE Interest rate per period NPER Number of payment periods PMT Amount paid each period.

If you wonder how to calculate the Net Present Value NPV by yourself or using an Excel spreadsheet all you need is the formula. The total value or equity value is then the sum of the present value of the future. WolframAlpha can quickly and easily compute the present value of money as well as the amount you would need to invest in order to achieve a.

The present value PV is equal to the discounted value of the series of cash flows at the discount rate r. Where represents the Present Value reflects the Cash flow at time and reflects the discount rate aka cost of capital.

Present Value Formula With Calculator

Present Value Pv Calculator

Present Value Definition Example Step By Step Guide

Time Value Of Money Present Value Vs Future Value Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv What It Means And Steps To Calculate It

Present Value Formula What Is Present Value Formula Examples

Present Value Calculator Basic

Present Value Calculator

Present Value Of An Annuity How To Calculate Examples

Present Value Formula With Calculator

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

:max_bytes(150000):strip_icc()/Clipboard01-618bfd11c29a4e2dbd2a50ea127f34d1.jpg)

Present Value Excel How To Calculate Pv In Excel

/NPVFormula-5c23ea8f46e0fb00013d2624.jpg)

Net Present Value Vs Internal Rate Of Return

Calculating Present Value Accountingcoach

Present Value Of An Annuity How To Calculate Examples

Present Value Of A Single Cash Flow Finance Train

Present Value Formula Calculator Examples With Excel Template